We believe that together, we can make a significant difference. Your generous donation ensures that our gardens continue to flourish, providing a haven for both visitors and the local ecosystem. Your support keeps our gardens vibrant and mission alive.

There are many ways to give.

Click on the links below to find out how.

Gifts

Our mission is fueled by your generosity! As we continue on our journey toward a sustainable future for all living things, please consider giving today and ensure that Tohono Chul thrives well into the future.

Without you, Tohono Chul would soon become part of the urban landscape. Your donations have helped us expand our programming, improve our infrastructure, continuously beautify our gardens, and extend our mission to a vast audience. Your gifts ensure that our gardens, programs, and mission will be here for generations to come.

That’s why we ask that you consider giving back to Tohono Chul in the form of time, effort, expertise, or a monetary donation. Your time and donations help ensure that the property preserved by Dick and Jean Wilson will continue to thrive as a premier Tucson botanical garden and cultural center.

Tohono Chul is a 501(c)3 Arizona non-profit corporation and is not funded by your taxes.

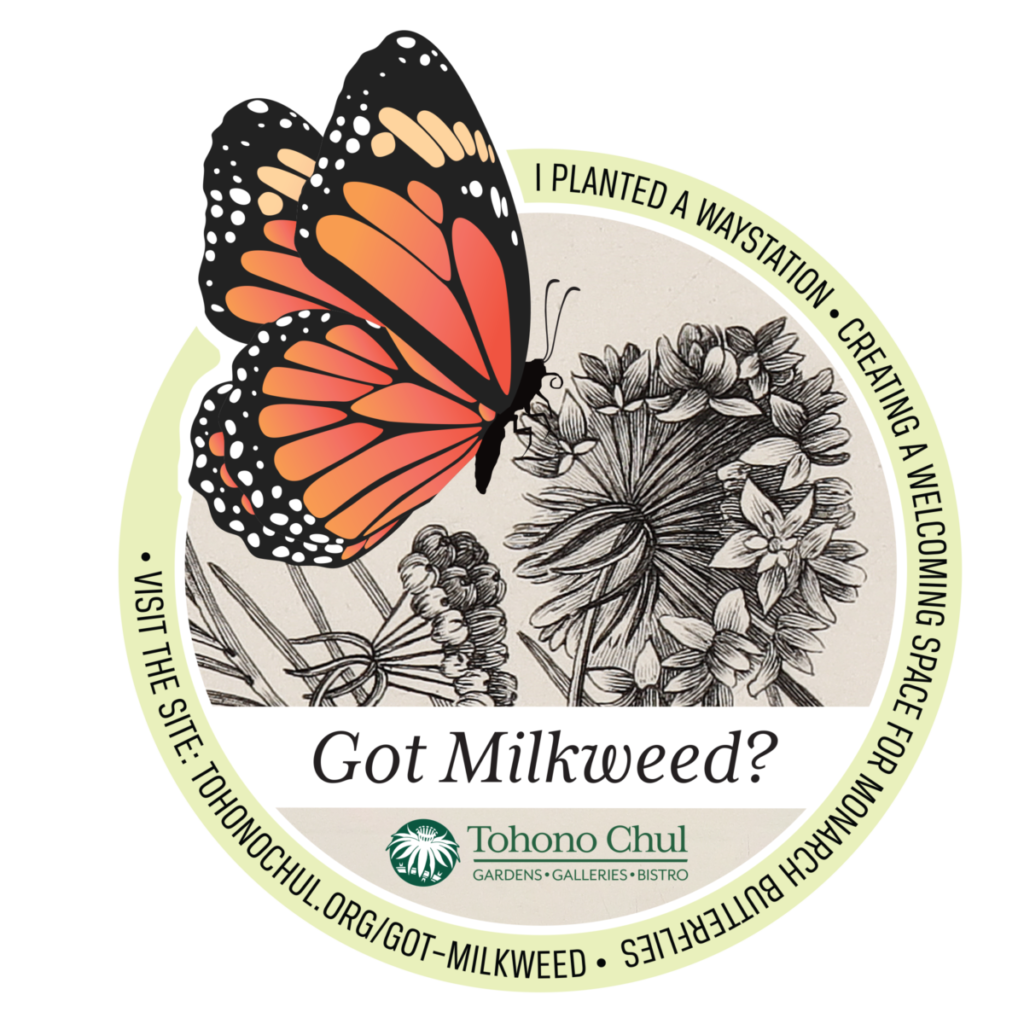

Got Milkweed?

Each fall, hundreds of millions of monarch butterflies migrate from the United States and Canada to mountains in central Mexico where they wait out the winter until conditions favor a return flight in the spring. The monarch migration is truly one of the world’s greatest natural wonders yet it is threatened by habitat loss.

With its own Butterfly Garden and the initiation of the Milkweed Project, Tohono Chul is working to increase monarch habitat by encouraging our friends to install waystations across the Sonoran Desert. We invite you to join us in this effort!

You can play an important role in helping to keep monarchs alive and well by planting milkweed seeds and creating your own monarch waystation. Although monarch butterflies feed on many different kinds of plants, milkweed is essential for the species.

Make a minimum $75 donation to Tohono Chul and receive a special “Got Milkweed?” seed packet! Your packet will include desert milkweed seeds, seeds for other butterfly host plants, a “Got Milkweed” yard sign, a special bumper sticker, and an information pamphlet on how to plant your seeds.

To receive your Got Milkweed? seed packet, select “Got Milkweed?” in the campaign options list on the Make Your Gift page. Please be sure to include your shipping address so we know where to send your seeds!

Why it Matters

Butterflies are “accidental pollinators.” They aren’t specifically looking for pollen but visit flowers looking for nectar and then transfer pollen and fertilize plants in the process. Pollinators are vital to supporting our food system. Without pollination, plants cannot produce fruit or seeds.

Questions? Don’t hesitate to reach out to the philanthropy department at philanthropy@tohonochul.org.